Following an evaluation by the Asia/Pacific Group on Money Laundering (APG), Papua New Guinea (PNG) has nine months to strengthen its Anti-Money Laundering (AML) framework or risk being placed on the grey list. The APG, a regional regulatory body, found that PNG is falling short in complying with the AML standards set by the Financial Action Task Force (FATF)—an intergovernmental policy-making body. This blog post is the first of a two-part series that explores PNG’s current standing in meeting FATF regulations; the second part will examine the potential consequences of being grey-listed.

This is not the first time PNG has received such a warning since joining the APG and adopting international AML/Counter-Terrorism Financing (CTF) standards in 2008. After its first evaluation in 2011, PNG received a warning and was eventually placed on the grey list in 2014 due to its failure to implement necessary corrective measures. However, reforms pushed by the government in 2015—including amendments to key legislation—led to PNG being removed from the grey list in 2016.

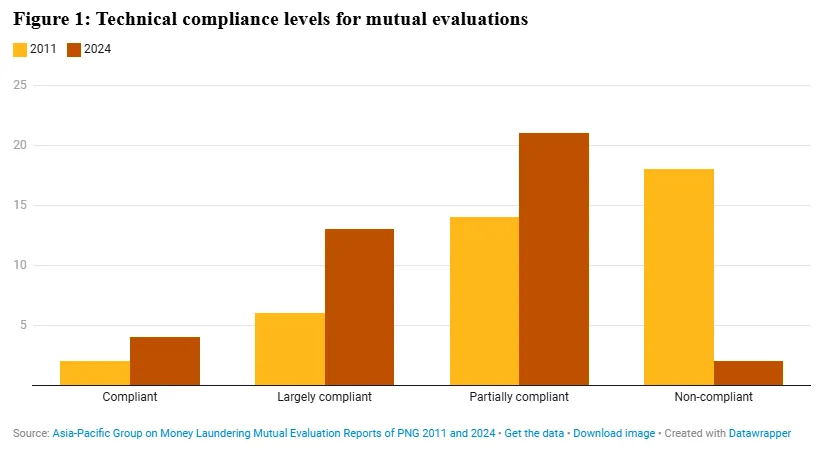

In both the 2011 and 2024 evaluations, PNG was primarily assessed on its “technical compliance” with AML/CTF measures. Technical compliance refers to whether a country has all the necessary laws, regulations, and legal instruments in place that meet the technical requirements of the FATF’s 40 Recommendations.

The good news is that, as shown in Figure 1, PNG has made some improvements in this area. In 2011, PNG met the technical compliance standard for only two of the 40 FATF Recommendations. By 2024, that number had risen to four. In addition, PNG saw increases in the number of standards rated as “largely compliant” or “partially compliant”, while the number of “non-compliant” ratings dropped significantly—from 18 down to just two.

At first glance, the situation appears manageable.

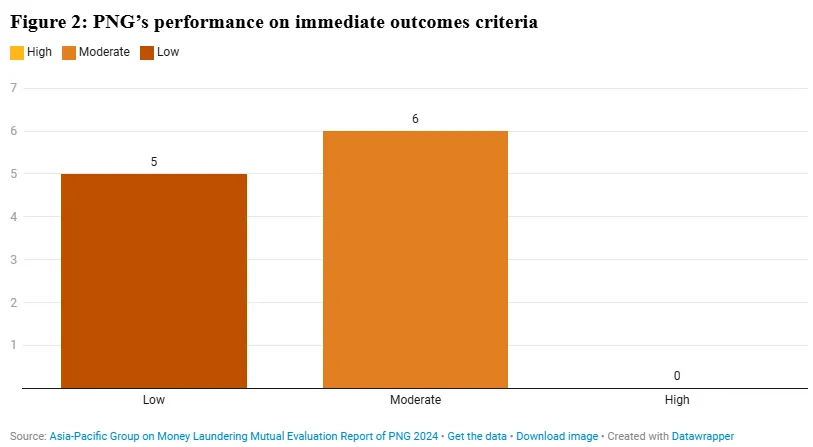

However, in 2013—after PNG’s 2011 evaluation—the criteria for assessing national compliance were substantially revised. Countries are now also assessed based on the effectiveness of their AML/CTF measures. This standard evaluates whether a country has genuinely implemented its laws, regulations, and policies and whether they are being effectively used.

With this raised bar, can PNG rise to the challenge? In short, the outlook is not promising.

The 2024 evaluation revealed that PNG performed poorly on effectiveness indicators—known in APG terms as “Immediate Outcomes”. As shown in Figure 2, PNG scored “moderate” effectiveness in six areas and “low” effectiveness in five.

The APG’s Mutual Evaluation Report (MER) noted that since PNG adopted the FATF’s AML/CTF standards in 2008, only two money laundering cases have been prosecuted. However, our own review of the PacLII (Pacific Islands Legal Information Institute) website suggests that the actual number may be slightly higher—though still worryingly low. We found five successful money laundering convictions, four of which were for “self-laundering” and one involving cocaine trafficking. Even so, this conviction rate remains disturbingly insufficient.

It is particularly concerning that none of these successful prosecutions relate to sectors identified as high-risk in both the 2024 APG evaluation and PNG’s own risk assessments. As early as 2017, PNG authorities had already designated corruption and bribery, fraud in government projects, illegal logging and fishing, and tax evasion as major high-risk areas. These vulnerabilities were reaffirmed in the APG’s 2024 assessment.

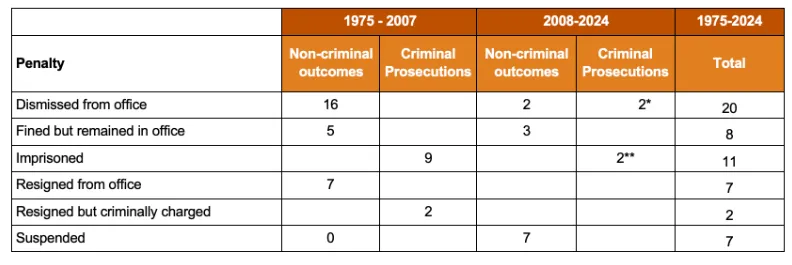

Moreover, although politicians—referred to in AML terminology as Politically Exposed Persons (PEPs)—are frequently accused of corruption and money laundering, PNG’s record on sanctioning them has actually worsened.

Table 1 outlines sanctions imposed on politicians across two periods: 1975–2007 (32 years) and 2008–2024 (16 years). Logically, the latter period should see about half the number of sanctions, but the data shows a sharp decline in both non-criminal and criminal penalties post-2008. Between 2008 and 2024, only four politicians were dismissed, compared to 16 from 1975 to 2007. Criminal convictions fell from nine to just two.

Sources: Ketan (2007) for 1975–2007 data; Grant Walton and Michael Kabuni for 2008–2023 data. *Two MPs sentenced to prison were subsequently dismissed. **One MP, Potape, served a seven-month sentence, but the Supreme Court later overturned the conviction, so it is not included as a criminal conviction in this analysis.

The Parakagate scandal highlights severe inefficiencies in PNG’s justice system. The case involved the then Minister for Justice illegally authorizing large payments to the private firm Paraka Lawyers to represent the government in civil cases, even after contracts had been terminated. It took a decade to bring the firm’s head, Paul Paraka, to justice. Though he was eventually convicted, the government has yet to recover the K162 million in misappropriated funds. Moreover, although money laundering was part of the original charges—since funds were laundered through seven law firms and one accounting firm—these charges were ultimately dropped.

Additionally, successful AML actions are often not publicly disclosed. For example, in 2023, the Internal Revenue Commission successfully recovered K140 million in unpaid taxes. However, it did not release the names of the companies involved. It remains unclear whether withholding the identities of these foreign companies aids PNG’s efforts to avoid being grey-listed.

The APG report listed nine priority areas where PNG must take action to improve compliance. These include legislative reform, funding and capacity-building, inter-agency cooperation, public awareness, and regulatory oversight.

However, given internal conflicts among PNG’s anti-corruption agencies, unresolved funding issues, weak law enforcement capacity, and—as discussed above—a chronically low prosecution rate, it is unlikely that PNG will be able to avoid grey-listing when the APG conducts its next assessment in November.

In the next article, we will explore another critical question: Does PNG truly deserve to be placed on this “notorious” list?