Income tax is a hot and highly sensitive issue in Papua New Guinea (PNG). The riots that erupted in Port Moresby this January were triggered by a police strike over payroll errors, exacerbated by rumors that the income tax threshold would be reduced.

Income tax deserves to be a central topic in PNG’s national discourse, as it is critical to the country’s economy, contributing around 4% of GDP. This figure is only about half the 8–9% average personal income tax revenue seen in developed economies but is double the 2% average for developing countries (IMF Report, Figure 3). This disparity reflects PNG’s highly dualistic economy, with both a large resource sector and a substantial rural population. One study showed that PNG ranks fourth among 59 low-income countries in terms of direct taxes as a percentage of GDP and has the highest ratio of direct to indirect taxes.

So, how has PNG’s income tax system evolved? And how can it be improved?

In our Devpol Discussion Paper, we reviewed all changes to PNG’s income tax system since independence and recorded 17 amendments, ranging from major reforms to minor adjustments.

The key changes can be summarized as follows:

- The number of tax brackets has been reduced by two-thirds — from 12 at independence to just 4 today.

- The top marginal tax rate has slightly declined — from 50% at independence to 42% now.

- The income threshold at which the top tax rate applies has shown a general downward trend (though inconsistently). Currently, the top 42% rate applies to annual incomes of K250,000, whereas at independence the 50% rate applied only to incomes equivalent to K700,000 in today’s prices.

- After adjusting for inflation, the tax-free threshold has seen little real change. When it was introduced in 1987, it was equivalent to today’s K20,300; today it stands at K20,000 — virtually the same.

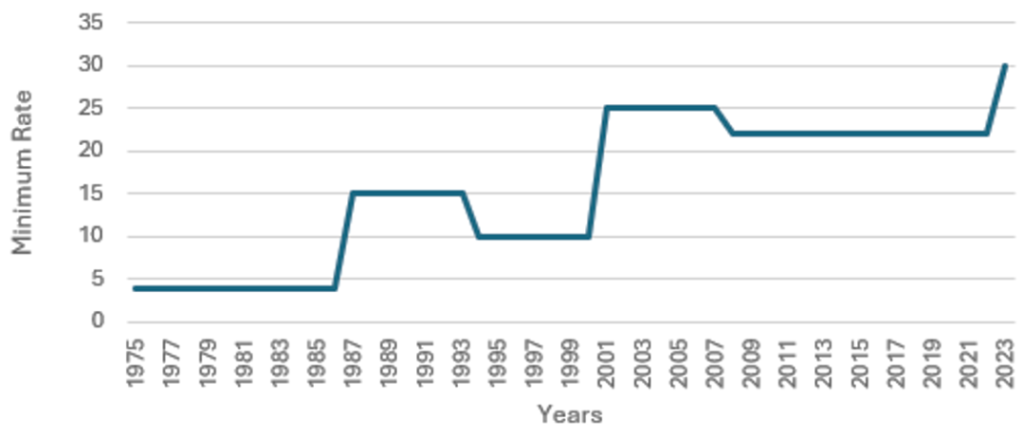

- The lowest non-zero tax rate has increased significantly. Initially, it was 4%. When the tax-free threshold was introduced in 1987, the lowest non-zero rate was 15%. Today, it stands at 30%.

- The gap between the highest and lowest non-zero tax rates has narrowed dramatically. The difference is now only 12 percentage points (42% – 30%), compared to 46 percentage points (50% – 4%) at independence.

A key feature of the income tax system is its progressivity — the idea that those who earn more should pay more. Overall, we find the system is more progressive than it was at independence, mainly due to the introduction of the tax-free threshold in 1987. However, the system has become less progressive since then, largely because of the steep rise in the lowest non-zero tax rate, as shown in Figure 1.

Figure 1: PNG’s Minimum Non-Zero Income Tax Rate

Note: There was no tax-free threshold before 1987. Source: Author’s discussion paper.

In fact, PNG now has the highest minimum non-zero tax rate in the region — 30% — followed closely by Indonesia at 28%. Most other countries in the region apply minimum non-zero tax rates between 5% and 20%, while the global average for developing countries is around 15%. Although PNG’s 2015 Tax Review Commission recommended reducing the minimum non-zero rate, it has continued to rise.

Today, after adjusting for inflation, the tax-free threshold is essentially the same as it was in 1987. However, the tax rate faced by those just above that threshold has doubled over the same period — from 15% to 30%. To restore the progressivity of the tax system to its 1987 level, the minimum non-zero rate should be reduced.

Of course, lowering the non-zero tax rate — say, reverting it to 15% — would reduce government revenue, which would need to be offset through other means, such as adjusting the tax structure, increasing other forms of taxation, or reducing government expenditure. In our view, this would be worthwhile. From a historical, regional, or international perspective, PNG’s current 30% minimum non-zero rate is clearly too high.