Against the backdrop of persistent global geoeconomic turbulence, Papua New Guinea (PNG) is undergoing a period of moderate economic adjustment.

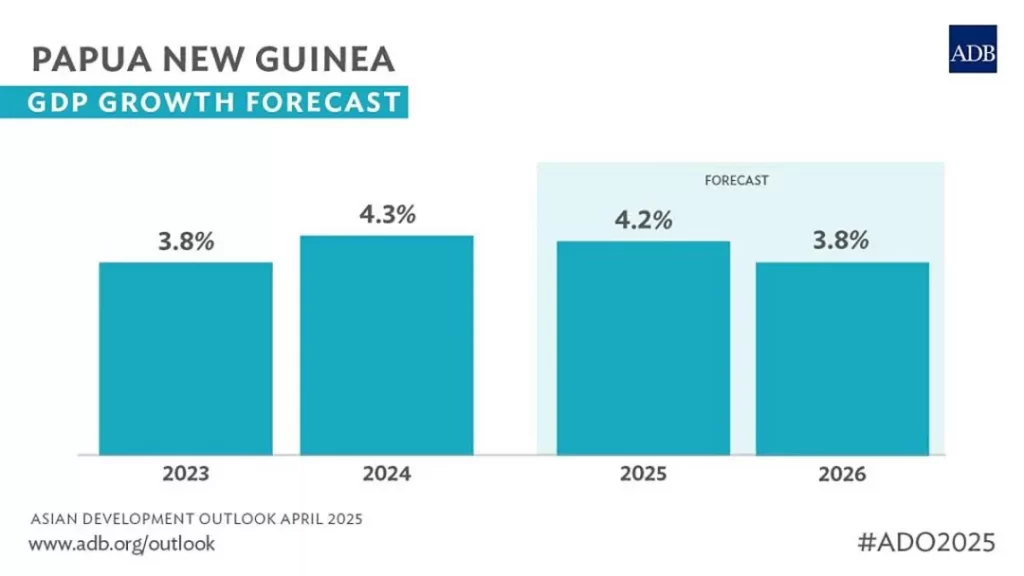

In its Asian Development Outlook (ADO) released in April 2025, the Asian Development Bank (ADB) reported that while PNG’s economy grew by 4.3% in 2024—driven by both resource and non-resource sectors—growth is expected to decelerate in the coming years, with forecasts of 4.2% in 2025 and 3.8% in 2026.

These figures reflect more than just economic fluctuations—they reveal the dual pressures facing the Pacific island nation amid complex international dynamics and persistent structural challenges at home.

ADB Country Director for Papua New Guinea, Said Zaidansyah, acknowledged the government’s progress in macroeconomic reforms, particularly in domestic revenue mobilization and deficit reduction. “These are commendable efforts,” he noted. “However, with rising external shocks, strengthening internal economic resilience must now become a top priority.”

One noteworthy development in 2024 was the reopening of the Porgera Gold Mine, which was initially seen as a positive signal for reviving economic momentum. Yet, its full production potential has been hampered by landslides and social unrest in the surrounding region.

Additionally, declining liquefied natural gas (LNG) output has weighed down overall hydrocarbon production. In contrast, exports of copper, coffee, cocoa, copra, and fisheries remained robust, buoyed by strong global commodity prices.

Looking ahead to 2025, mining will remain a key driver of growth, particularly with the anticipated increase in Porgera’s gold output. However, oil and gas production is projected to remain stable or even decline slightly, due to increasing volatility in global energy prices.

The report emphasizes that PNG’s challenges go beyond natural resource dependency. Structural issues—such as frequent power outages, security concerns, the potential risk of being grey-listed over anti-money laundering deficiencies, and high business operating costs—continue to hinder economic progress.

At the same time, global trade tensions are compounding these difficulties.

Notably, the ADB’s growth forecast was finalized before the U.S. government announced a new round of tariffs on April 2, and thus does not account for potential impacts from that policy shift. However, the report warns that heightened U.S. policy volatility and uncertainty could have cascading effects on global trade, investment, and economic growth.

Inflation in PNG fell to a record low of just 0.7% in 2024, largely due to a sharp decline in betel nut prices. However, such price swings are unlikely to be sustained, especially with food, clothing, and footwear costs remaining high. ADB forecasts inflation to rise to 3.8% in 2025 and 4.3% in 2026.

The report concludes that improving access to foreign exchange and reducing import backlogs will be crucial to building a more favorable environment for private sector development. These steps would not only help attract foreign investment but also support the gradual formation of a resilient domestic industrial base—transforming PNG’s growth path from quantity to quality.